In 2026, demand-side platforms will surpass media buying tools in popularity as programmatic advertising continues to mature. Additionally, DSPs today integrate automation, data intelligence, privacy-safe targeting, and omnichannel reach into a single ecosystem. This is particularly significant.

To remain competitive, many teams need to understand how top DSPs are transforming and to deepen their grasp of the fundamentals of adtech.

This guide examines the state of DSP in 2026, the leading market platforms, key trends in programmatic advertising, and the approach to choosing a demand-side platform for sustainable growth.

Table of Contents

The State of DSPs in 2026

Beyond media buying and bid management, the concept of a demand-side platform has developed. The distinguishing features of modern DSPs include their flexibility, privacy protection, and ability to optimize campaigns in complex and data-intensive settings.

The purpose of modern DSPs is to ensure optimal performance and control while maintaining a multi-layered ecosystem. This includes data storage, processing, and networking. Advertisers can now manage their display, mobile, video, audio, and DOOH campaigns using a single platform, which is known as true all-in-one buying. At the same time, campaign strategy now depends heavily on first-party data; DSPs are enabling secure activation of data via clean rooms and privacy-safe integrations.

DSPs have shifted their focus from passively altering bids to using AI-driven models to forecast outcomes, allocate budgets dynamically, and optimize for attention, engagement, or conversion quality. Brand safety and fraud prevention have become integral parts of the system, rather than added features.

The environment no longer focuses on distinguishing between transparency, supply-path optimization, advanced analytics, and strong privacy compliance as core requirements. Programmatic ads are headed by DSPs that are quick to adjust to changes in regulations and inventory conditions.

Top 7 DSP Platforms: Strengths & Weaknesses

As programmatic advertising evolves, a number of top demand-side platforms have emerged that will shape the landscape in 2026. Various advertisers, campaign objectives, and media strategies are served by each platform with its own set of capabilities.

From AI-driven optimization and omnichannel reach to issues with transparency, inventory access, or suitability for certain campaign types, all feature prominently in this list of seven DSPs. These platforms can be compared to help teams decide which type of DSP best suits their objectives, resources, and growth plans.

In order to create effective programmatic strategies by 2026, it is essential to understand the advantages and drawbacks of each DSP.

Adobe Advertising Cloud

The most advantageous decision is made when using multiple Adobe products. Adobe Advertising Cloud is the perfect fit for brands already operating within the Adobe ecosystem who want to manage customer journeys.

Strengths:

- deep integration with Adobe Experience;

- platform advanced audience segmentation & personalization;

- strong enterprise-level reporting & analytics.

Weaknesses:

- high learning curve for smaller teams;

- cost may be prohibitive for mid-market advertisers;

- the best value comes only when using multiple Adobe products.

Source: Adobe Advertising Cloud.

Adtelligent DSP

One of the key factors in establishing Adtelligent DSP as an industry standard is its emphasis on transparency, modular logic settings, and efficient access to premium inventory. Teams that prioritize flexibility and control are well-suited for the platform.

Strengths:

- transparent auction mechanics & pricing;

- flexible campaign customization;

- strong focus on performance optimization & SPO;

- has its traffic sources connected to DSP;

- suitable for white-labeling.

Weaknesses:

- smaller global brand recognition than legacy DSPs;

- limited demographic and behavioral targeting options;

- need to add DMP or the client’s own CDP data.

Source: Adtelligent.

Amazon DSP

Remember that the open web’s transparency may be a concern for advertisers, despite Amazon DSP being the most popular in retail media.

Strengths:

- unmatched access to Amazon’s first-party retail data;

- strong performance for commerce-driven campaigns;

- cross-device reach both on and off Amazon properties.

Weaknesses:

- limited transparency into auction dynamics;

- best suited for brands selling on Amazon;

- limits of regions and locations.

Source: Amazon Ads.

Google Display & Video 360 (DV360)

DV360 remains one of the best demand-side platforms for scale, but it offers less control compared to independent DSPs.

Strengths:

- seamless integration with Google Marketing;

- platform broad inventory access across AdSense, TV, and audio;

- advanced frequency & reach management.

Weaknesses:

- limited transparency into fees & supply paths;

- dependence on Google’s ecosystem;

- high price;

- lack of support and dependence on intermediaries.

Source: Google Marketing Platform.

Microsoft Ads

Microsoft has exited the standalone DSP market by sunsetting Microsoft Invest (formerly Xandr DSP) and partnering with Amazon DSP for programmatic buying. Microsoft Ads now focuses on its first-party ecosystem (Bing, LinkedIn, Outlook, MSN, Xbox) and AI-driven advertising solutions.

Strengths:

- Strong first-party data across search, professional, gaming, and productivity environments

- Deep AI and automation capabilities via Microsoft ecosystem

- Tight integrations with Microsoft-owned properties

- Transition path to Amazon DSP for programmatic scale

Weaknesses:

- No longer operates its own full-scale DSP

- Increased dependency on Amazon DSP for programmatic buying

- Reduced control for advertisers seeking a Microsoft-native DSP stack

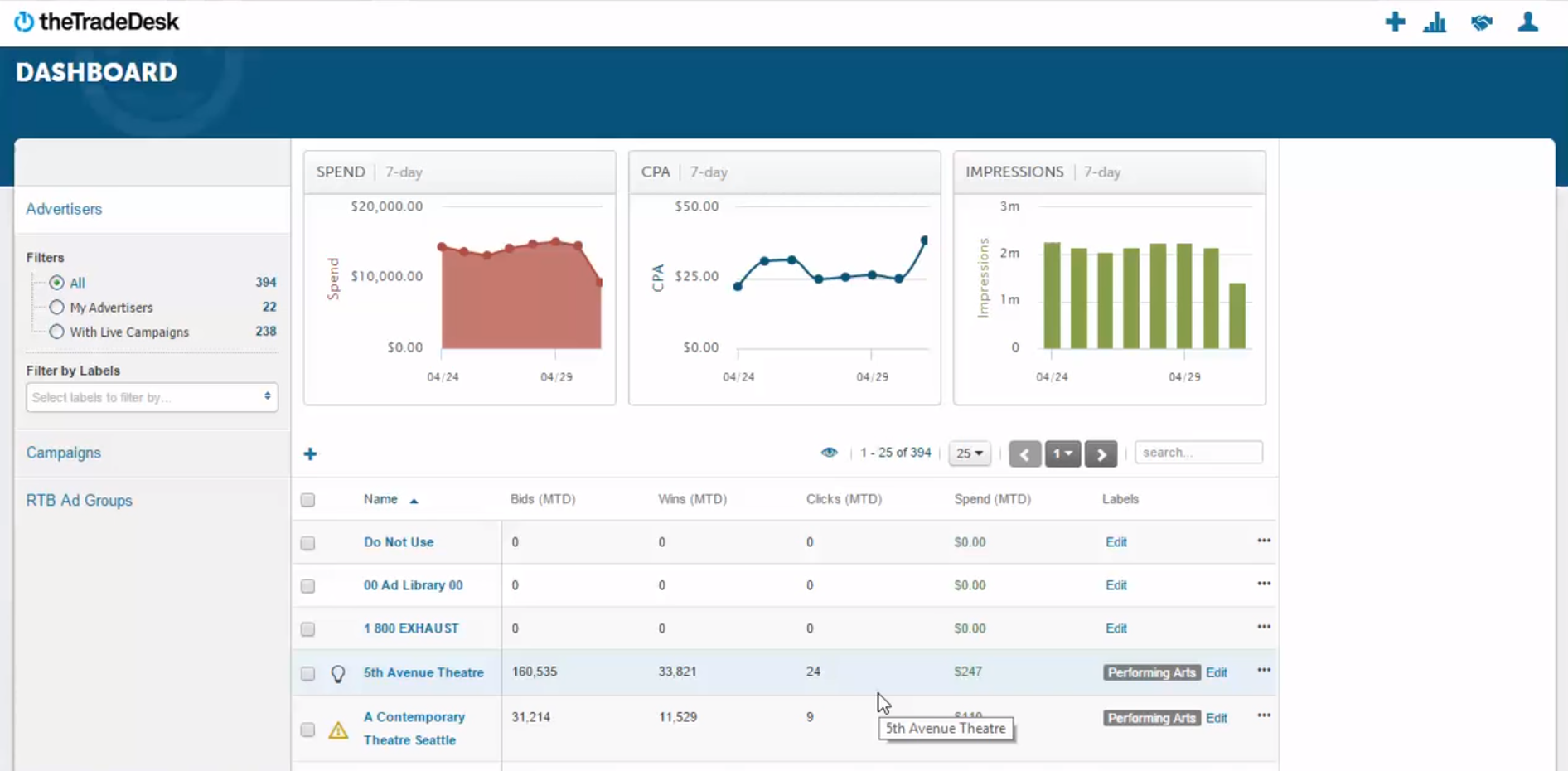

The Trade Desk

The Trade Desk remains the primary source of innovation, particularly in identity solutions and CTV procurement.

Strengths:

- strong independent DSP positioning;

- advanced data marketplace & UID2 adoption;

- robust CTV & premium inventory access.

Weaknesses:

- steep learning curve;

- premium pricing model;

- traffic difficulties beyond North America and Western Europe.

Source: GetApp UK.

StackAdapt

StackAdapt is designed to be useful for mid-sized teams that require simplicity and contextual thinking.

Strengths:

- user-friendly interface;

- strong contextual targeting capabilities;

- ideal for content-driven & native campaigns.

Weaknesses:

- limited custom bidding logic;

- less advanced for large-scale omnichannel buying;

- smaller inventory footprint compared to major DSPs.

Yahoo DSP

Yahoo DSP is still relevant for reach-centric and brand-focused campaigns.

Strengths:

- strong native & premium content placements;

- access to Yahoo-owned inventory;

- competitive pricing for upper-funnel campaigns.

Weaknesses:

- less innovation compared to newer DSPs;

- limited flexibility in advanced optimization;

- smaller ecosystem than Google or Amazon.

Source: RudderStack Docs.

Top DSPs Comparison Table

Programmatic Trends To Watch in DSPs

The evolution of DSP is accompanied by a number of key trends that will change the approach to programmatic buying in 2026. The trend is accelerating for demand-side platforms to move away from automation and towards data-driven solutions that prioritize privacy, analytics, and supply chain transparency. This is an emerging trend.

Agentic AI and Autonomous Optimization

DSPs are increasingly adopting Agentic AI – systems that can act autonomously to plan, optimize, and execute campaign decisions with minimal human intervention. Instead of just suggesting optimizations, agentic models can adjust bids, reallocate budgets, and refine audience segments in real time based on performance patterns. This shift empowers advertisers to scale campaigns more efficiently, reduce manual setup, and respond dynamically to market changes.

Connected TV & DOOH Growth

Budgets for brand and performance remain high due to CTV and digital out-of-home. Cross-screen frequency management is now necessary due to the availability of DSPs that offer unified planning across linear-like reach and digital measurement.

Retail Networks Expansion

E-commerce giants are no longer the only ones that use retail media networks. Grocery chains, delivery apps, and physical retailers are increasingly monetizing data, which is leading to the need for DSPs to integrate retail inventory with ease.

First-Party Data & Clean Rooms

With third-party cookies gone, DSPs rely on first-party data activation via clean rooms. Privacy-safe matching enables advertisers to use CRM data without exposing user-level information.

Alternative IDs & Curated Audiences

Solutions like UID2, publisher-provided IDs, and curated audience packages help maintain addressability. The best DSPs support multiple identity frameworks simultaneously.

Attention Metrics & Predictive Analytics

Today, DSPs go beyond impressions and click metrics, focusing on attention-based KPIs. This applies in particular to tracking visibility time, engagement probability and predictive conversion modeling.

Supply-Path Optimization (SPO)

SPO has become a core DSP feature, helping advertisers reduce intermediaries, lower fees, and improve win rates. Transparent supply paths are now a competitive advantage.

Dynamic Creative Optimization

Real-time creative optimization beyond basic A/B testing is becoming a more prevalent feature in DSPs. Changes in messaging, visuals, formats, and calls to action can be controlled dynamically based on context or audience signals, as well as device type and live performance data. Ads can use this method to maintain relevance on a global scale, enhance engagement, and drive higher conversion rates across channels.

Brand Safety & Fraud Prevention

DSP capabilities have evolved from optional features to basic ones that prioritize brand safety and fraud prevention. Modern demand-side platforms utilize advanced pre-bid filtering, post-bid analysis, and AI anomaly detection to minimize invalid traffic and maintain brand credibility. Advertisers are now anticipating transparent reporting and safeguards that guarantee their ads appear in secure, top-notch settings.

Choosing the Right DSP

A demand-side platform is selected based on the business’s objectives and data quality level. When evaluating top DSPs, consider:

- inventory access & transparency;

- support for omnichannel campaigns;

- integrated data & compatible with clean room;

- custom optimization & bidding logic;

- reporting depth & real-time insights.

The best demand-side platform, however, does not have a universal one. It’s not just about market share, but also about the DSP that works best for your strategy.

Staying Competitive in 2026

In order to compete in advertising by 2026, it is essential to incorporate first-party data, transparency, and supply chain optimization. The evaluation of CTV and retail media requires early testing, as well as a shift away from last-click attribution and towards more comprehensive measurement. Success in programmatic purchasing is increasingly dependent on the use of DSPs as strategic partners, not just automated tools.

What’s Next for Programmatic Buying?

In 2026, programmatic buying is based on intelligence rather than scale. Real-time integration of data, media, and creativity is becoming a reality for DSPs as decision engines.

Stronger privacy requirements and inventory fragmentation will drive the development of DSPs focused on efficiency, transparency, and flexibility. It is the teams that recognize these changes early on that will shape the next phase of digital advertising.

*The list of top solutions is presented in alphabetical order.

FAQ

What is the difference between a DSP and an advertising platform?

A DSP lets advertisers buy inventory across multiple publishers and channels via programmatic auctions. An advertising platform (like Meta, TikTok, or Amazon Ads) is limited to its own inventory and operates as a closed ecosystem.

What is the difference between a DSP and an ad server?

They serve different purposes in the ad tech stack.

DSP → buys media and manages bidding, targeting, and optimization

Ad server → delivers ads and tracks impressions, clicks, and conversions

Most advertisers use both together.

Are Meta, TikTok, Pinterest, and Reddit Ads DSPs?

No. These are standalone advertising platforms, not DSPs.

They sell ads only within their own environments:

Meta → Facebook, Instagram, Audience Network

TikTok → TikTok placements

Pinterest → Pinterest inventory

Reddit → Reddit placements

DSPs provide access to open web, CTV, DOOH, retail media, and in-app inventory beyond one platform.

Can I integrate my own user data into a DSP?

Yes, you can integrate your own user data into a DSP. Most DSPs support first-party and partner data, including CRM, CDP, retail, and privacy-safe ID solutions. In 2026, DSPs focus on cookie-light and privacy-first data activation.

Do DSPs support third-party measurement?

Yes. Leading DSPs integrate with third-party tools for viewability, brand safety, fraud detection, and attribution, especially for video and CTV campaigns.

Can one DSP run CTV, DOOH, and retail media campaigns?

Often yes, but it depends on the platform.

Many DSPs, such as Adtelligent DSP, now support CTV, DOOH, and retail media within a single interface, enabling unified reporting and frequency control across channels.